Germany ‘on brink of recession’ as energy crisis hits confidence

Germany is on the brink of recession as rising energy prices and fears of gas shortages dampen confidence, a new survey has revealed. Read also : The Virtual Enterprise: Building a more connected, expansive enterprise.

The research institute IFO has reported that the strength of the German industry fell this month to the lowest level in two years.

Companies are afraid that business will increase significantly in the coming months, with manufacturing companies especially in the dark.

The IFO business index fell to 88.6, from June’s 92.2, a sharper-than-expected drop, leaving much of Europe on the brink of the skin.

It is the worst reading since June 2020, during the first Covid-19 lockdown, when the world economy fell into recession.

President Clemens Fuest said.

“Germany is on the brink of collapse,”

High energy prices and the threat of gas shortages are weighing on the economy. Companies are expecting worse business in the coming months.

The IFO index of current economic conditions fell to 97.7, from June 99.4, while its expectations fell to 80.3 from 85.5, indicating an increase in the confusion on the board.

Uncertainty in manufacturing about the coming months has reached its highest level since April 2020, with retailers reporting a decrease in new orders.

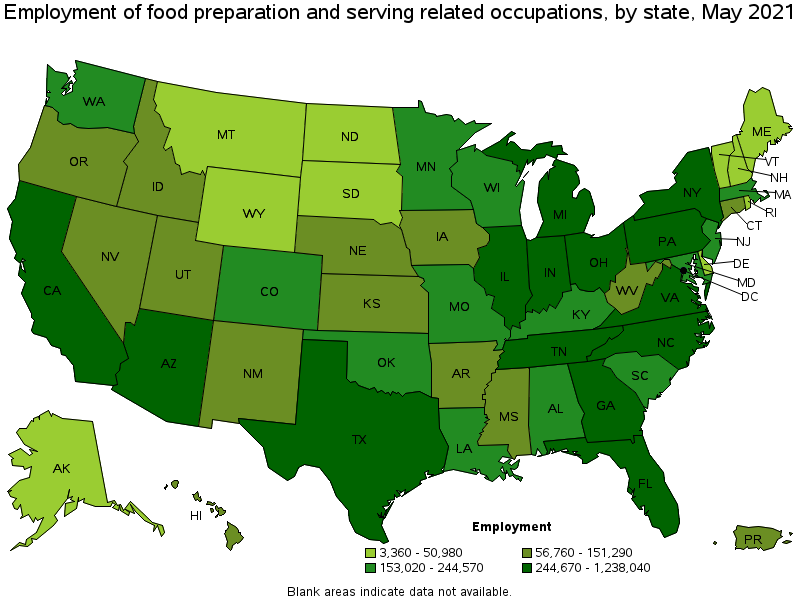

In the service sector, the cost of business has been severely damaged, with falling expectations, including the tourism and hospitality sectors.

Conditions also worsened in the retail and construction industries.

German IFO very happy vs view today

See how much German Business expectations have fallen over the past year. 20 points! pic.twitter.com/9WSzXTKJQw

Last week the German economy minister announced a new wave of emergency measures to reduce the country’s gas consumption.

Flows from Russia through the North Stream 1 pipeline resumed at reduced levels last week, after a planned shutdown that caused long-term fears.

This is our latest news on Ryanair which highlights the risk of new virus changes in the autumn, as it publishes its first earnings since the coronavirus pandemic.

UK industrial output growth weakest since April 2021

Production growth in Britain’s manufacturing industry has slowed to its slowest level in a year. Read also : Why the global inflation problem is bigger than US politics.

The CBI’s latest ‘Industrial Trends’ survey found that total production and new orders in the July quarter increased at the fastest pace since April 2021.

The balance sheet is +6 of companies that reported an increase in production in the last three months, down from +19 in April, as domestic and foreign demand decreased.

Anna Leach, CBI Deputy Chief Economist, said:

“The manufacturing sector has been an economic success in recent months, but jobs and orders have weakened amid continued inflation, supply constraints and a general weakening of economic conditions in the UK. and the whole world.

The July CBI/@AccentureUK Industrial Trends Survey found that growth in manufacturing output eased in the July quarter, slowing to a normal rate of expansion after a period of strong growth in the last year. #ITS pic.twitter.com/S221GdfJKr

Encouragingly, employment expectations for the coming year rose compared to April.

Companies also reported lower prices, with steel producers, as well as plastics and electronics manufacturers reporting lower prices.

Investment expectations for the coming year have increased compared to April for plants & machinery, products & innovation, and training. Housing investment is expected to decline slightly in the year ahead, although the balance remains above the long-term average. #ITS pic.twitter.com/VFIcKNGA8g

Lufthansa strike announced

Germany, like Britain, is also seeing an increase in industrial activity as workers push companies to raise profits to meet rising costs. Read also : As prices rise, Americans’ travel plans are coming back to Earth.

And today the German union called Lufthansa workers on a one-day walkout on Wednesday in a dispute over wages, reports the Associated Press, which will add to the disruption. travel.

The labor union ver.di said today that the call applies to all Lufthansa locations in Germany. It comes amid negotiations over wages for about 20,000 employees of the airline’s special, special and cargo companies.

The match was scheduled to start at 3:45 am (01:45 GMT) Wednesday and end at 6 am (04:00 GMT) on Thursday.

The union hopes to increase the pressure on Lufthansa before the next round of negotiations on August 3 and 4.

Lufthansa workers have just announced a one-day strike across Germany for Wednesday. This will affect 20,000 workers at major airports such as Frankfurt and Munich, adding to the chaotic situation at many German airports.

The Japanese government has cut its economic growth forecasts for this fiscal year, warning that foreign demand is slowing.

Japan’s GDP is expected to grow by just 2% this year, down from the previous estimate of 3.2% back in January.

Recent data include higher sales and consumer spending, due to rising food prices and the strength and weakness of the yen (which increased the cost of foreign goods).

Japan has also cut its growth forecasts abroad – it is now expected to expand 2.5% this year, compared to 5.5% previously.

ING: Germany faces ‘perfect storm’ as recession fears grow

Today’s drop in business confidence shows that the list of risks for the German economy is getting longer and longer, says Carsten Brzeski of ING:

The single biggest risk would be further interference with Germany’s energy use and a complete cutoff of Russian gas supplies, Brzeski explained:

The reopening of the NordStream1 pipeline last week has helped fill Germany’s gas reserves, which are about 66%. To get through the winter without Russian gas, the government planned to fill reserves to 90%.

This goal seems unattainable and explains why at the end of the week, the famous Green politicians opened the door to an extension of the last three nuclear power plants, which are planned to be closed at the end of this year.

The growing energy crisis will remain the main concern for the economy going into winter.

But the general outlook for the German economy is “anything but rosy”, with low water levels in key rivers such as the Rhine adding to supply problems:

Now, in the basic scenario with the continued supply chain, uncertainty and high energy and commodity prices due to the ongoing war in Ukraine, the German economy will be pushed to a technical standards.

To make matters worse, the current dry weather has reduced water levels in major rivers close to 2018, when low water levels caused disruption of supply lines. All this makes for a perfect storm in the second half of the year.

The German Business Price Index fell sharply to 88.6 points in July, from 92.2 points in June.

Tough months ahead for business in Germany. pic.twitter.com/pUgfNJPheS

Germany ‘on brink of recession’ as energy crisis hits confidence

Germany is on the brink of recession as rising energy prices and fears of gas shortages dampen confidence, a new survey has revealed.

The research institute IFO has reported that the strength of the German industry fell this month to the lowest level in two years.

Companies are afraid that business will increase significantly in the coming months, with manufacturing companies especially in the dark.

The IFO business index fell to 88.6, from June’s 92.2, a sharper-than-expected drop, leaving much of Europe on the brink of the skin.

It is the worst reading since June 2020, during the first Covid-19 lockdown, when the world economy fell into recession.

President Clemens Fuest said.

“Germany is on the brink of collapse,”

High energy prices and the threat of gas shortages are weighing on the economy. Companies are expecting worse business in the coming months.

The IFO index of current economic conditions fell to 97.7, from June 99.4, while its expectation fell to 80.3 from 85.5, indicating an increase in the confusion on the board.

Uncertainty in manufacturing about the coming months has reached its highest level since April 2020, with retailers reporting a decrease in new orders.

In the service sector, the cost of business has been severely damaged, with falling expectations, including the tourism and hospitality sectors.

Conditions also worsened in the retail and construction industries.

German IFO very happy vs view today

See how much German Business expectations have fallen over the past year. 20 points! pic.twitter.com/9WSzXTKJQw

Last week the German economy minister announced a new wave of emergency measures to reduce the country’s gas consumption.

Flows from Russia through the North Stream 1 pipeline resumed at reduced levels last week, after a planned shutdown that caused long-term fears.

A European Central Bank policymaker has hinted that more big interest rate hikes are on the way, after markets were surprised by a bigger-than-expected hike last week. .

Martins Kazaks told Bloomberg that another “very important” increase may be needed in September, on top of the 50-basis increase agreed at the July meeting.

Kazaks, who is a hawkish member of the EBC administration, said:

“I’m not saying this is the only front load,

I would say that the rate hike in September should also be very significant.

Kazaks declined to talk about possible conditions for the meeting in October but said there would be “no major objection” to recent market expectations for 150 basis points of tightening next June. More here.

🇪🇺 The European Central Bank may not do much with interest rate hikes after the surprise start of the half-point hike last week, according to Council member Martins Kazaks – BBGhttps://t.co/u5Ndswa58h

European stock markets have started the week with some losses, as fears of a recession continue to weigh on shares.

Oil companies are in decline in London, along with the gambling group Entain (-2.7%) and Haleon (-2.6%), the health care business bought by GSK last week .

More queues at Dover amid fears for ‘vulnerable’ summer

Queues are forming at the Port of Dover amid fears the spate of incidents seen in recent days could return to Kent throughout the summer. PA Media reports.

Ferry operator DFDS told passengers there would be “waiting of around an hour” for French border checks on Monday morning, and to “allow at least 120 minutes before departure to complete all authorities”.

P&O Ferries wrote on Twitter:

“The lines went up and it took about an hour to clear passport control.”

#PODOVER – There are queues at the entrance to the Port of Dover. It takes about 45 – 60 minutes to clear the passport process. Please allow extra time on your journey if possible and make sure that if you miss your sailing you will get on the next one.

There was also an hour’s wait to get through the border control at Calais to travel to Dover, P&O added, although the approach to Calais was clear.

#POCALAIS – The roads to Calais are clear but there are currently waiting times of around one hour at border control. Please allow extra time if possible on your journey. Please make sure that if you miss your crossing you will be at the next one

Toby Howe, senior manager of roads at Kent County Council and leader of the Kent Resilience Forum, said the current queues in Dover Town were “normal for a Monday morning”.

He told BBC Radio 4’s Today program that the weekend could be “very busy”.

“It’s the second busiest week of the summer holidays.

“As we know after the weekend, traffic numbers on the bridge have returned to pre-pandemic levels and the increased checks slow down the passage, so less enough to make those tails grow.”

Howe added, “Actually, it’s a very weak situation”, and it’s not likely to cause more problems.

Queues are forming at the Port of Dover amid fears the severity of incidents seen in recent days could return to Kent throughout the summer https://t.co/AsCtvVHDD0

UK restaurant insolvencies jump by more than 60%

Labor shortages and cost of living problems have forced many British restaurants to close their doors for good.

The number of restaurants that have fallen into insolvency has increased by more than 60% in the past year, according to research firm UHY Hacker Young.

It is reported that 1,406 restaurants in the UK closed their doors in the 12 months to May, up 64% on the previous year.

Peter Kubik, a partner at UHY Hacker Young, said the pressure on hosting companies is increasing.

“Restaurants that were able to survive the epidemic thanks to the support of the government are now facing new challenges in terms of rising economic costs, the lack of workers after Brexit and consumers can’t afford to spend more.”

This follows a number of high-profile restaurant businesses – including Byron, Gourmet Burger Kitchen and Italian chains Strada and Carluccio’s – forced to close several locations at the height of the pandemic as they racked up huge losses. during the ongoing lockdowns and other Covid. limits.

Two in five airport workers ‘thinking of quitting’

More than two in five airport workers are considering quitting, the survey suggests, which could worsen the delays seen at airports this year.

A survey of 1,700 employees by the UK jobs site CV-Library found that reasons for wanting to leave the industry included wanting more pay and less stress.

Two out of three of those surveyed said they had not had a pay rise in the past 12 months, despite the lack of workers caused airlines and airports to try to hire workers. Add here:

Ryanair shares dip

Shares in Ryanair fell almost 1% in early trading, as traders bought into Michael O’Leary’s warning that the recovery was ‘fragile’.

Victoria Scholar, the head of investment in trade exchange, pointed out that Ryanair’s shares are down by a third this year, due to a number of problems:

The industry is struggling with a number of crises from the oil prices, the war in Ukraine, the lack of workers and the spread of Covid-19. Disgruntled passengers have been on the front pages this summer with disruptions, cancellations and delays affecting the entire travel industry.

As a result, shares in Ryanair have struggled, down 30% since the high of February and the beginning of the war in Ukraine.

Analysts were impressed by Ryanair’s performance after it returned to profit for the last quarter [results are online here].

Stephen Furlong, analyst at Davy, said that its operations, growth, cost and balance sheet are “best in class,” with profits after tax of €170m model.

Stockbrokers Goodbody described the announcement as “a very strong set of numbers”.

Citi said that the Q1 price increase and the information on the prices ahead of the Covid situation “are likely to drive the improvement of the FY agreements.”

Aviation exporter Richard Schuurman has more information on Ryanair’s results:

.@Ryanair reports €170mln profit for its Q1 of FY23, compared to €-272.6mln last year.Operating profit €219.6mln versus €-304.5mln.Total revenue €2.6bln compared to €370.5mln, while the expenses reached €2.4 billion from €681 million. Oil prices increased by €1.0 billion from €156.6 million.

.@Ryanair says there is “limited visibility” in Q2, although prices are ahead of FY19. No guidance for FY23, but Ryanair is worried about the new Covid changes coming in the autumn/winter.

Ryanair has also indicated that the rise in fuel prices this year will increase its prices:

Although it is one of the most protected airlines in Europe, the high fuel prices will cause a price increase on 20% of the fuel that is not protected for the rest of the the FY23.

It also blamed the drop in customer satisfaction on persistent air travel delays, and airport chaos. this year.

Introduction: Ryanair signals risk of new Covid variants

Good morning, and welcome to our newsletter covering business, global economics and financial markets.

Budget airline Ryanair has warned that the air travel recovery is “very strong but still fragile,” as a jump in passenger numbers helped it return to cash. clean

Ryanair announced a pre-tax profit of €203m for April-June this morning, its first profit for the quarter since the start of the Covid-19 pandemic.

But chief executive Michael O’Leary has indicated that autumn could bring new challenges, if new strains of the virus emerge.

O’Leary told shareholders this morning that it was too early to issue a profit guidance for the current financial year, given the uncertainty:

Although we still hope that the high level of vaccination in Europe will allow the airline industry and tourism to fully recover and finally put Covid behind us, we cannot ignore the risk the new Covid changes in Autumn 2022.

Our experience with Omicron last November, and the Ukraine attack in February, show how fragile the air travel market remains, and that the strength of any recovery is a depends largely on the absence of unexpected or unforeseen events in the remainder of FY23.

Many variants of the rapid Omicron strain of Covid-19 have already been identified this year, causing an increase in cases and hospitalizations in some countries.

Ryanair’s Q1 profit was a recovery on the €324.5m before tax last year, boosted by the strength of traffic recovery. The number of passengers rose to 45.5m in the quarter, from 8.1m in 2021 when travel was restricted, and 9% more than Covid.

But Easter bookings and prices were “severely damaged” by Russia’s invasion of Ukraine in February, the airline added, pushing average passenger numbers down 4% due to Covid.

O’Leary said there are “clear signs” of demand disruption, but people are booking flights closer to their travel dates than before Covid.

Expressing a cautious statement, O’Leary said that this is a ‘significant later release’, with the lack of visibility on the horizon, conflicting oil prices, and “Potential Covid, geopolitical and supply chain ” makes it difficult to predict income this year.

We hope to be in a better position to do so at the half-year end in November, but, as our experience with Omicron last November and Ukraine in February showed, any strategy can change quickly from the unexpected to beyond. Our control over time remains very strong but recovery is fragile.”

Also coming up today

Motorists are facing further delays as the summer holiday season continues.

Dover port officials said yesterday that services are back to normal after days of chaos and long queues.

The border staff and boats worked “at night” to clear the mass of tourists and transports, after a “terrible incident” was revealed last week.

The situation returned to normal early Sunday morning, said the spokesperson of the port, but drivers may face another busy day crossing the River.

Lines of traffic are forming again at the Port of Dover and there are signs of another busy day for people trying to cross the River. The crisis at the Eurotunnel in Folkestone has been resolved. We speak to @_NatalieChapman @LogisticsUKNews#bbcgms 0740

The AA has warned that Folkestone is turning Dover into Britain’s ‘holiday destination from hell’, as tourists try to negotiate blockades in the area to get to the Eurotunnel terminal.

After last week’s gains, the UK’s FTSE 100 index is set to open 0.4% lower as economic concerns continue to weigh on markets.

Last week the world’s stock market enjoyed a positive trend. The markets appeared to be overbought. Inflation & Mixed income remains a concern. Earning profits in the fast proofs. Oil $102. Hot Asia. Recommended opening call: FTSE -30 @ 7246 DAX -82 @ 13171 CAC40 -32 @ 6184 DJIA -27 @ 13871

On the economic front, the CBI’s latest health check on UK factories has been released this morning, along with German business data and an analysis of economic activity in the US.

Hundreds of longshoremen at one of Britain’s biggest container ports in Liverpool will vote for action, in a dispute over pay and conditions.

The Unite union said last week that more than 500 workers at MDHC Container Services, part of Peel Ports, in Liverpool will be asked to vote on industrial action after the 7% salary offer was considered insufficient and the employees were not given an agreed bonus.

“Unite Union says more than 500 workers at MDHC Container Services, part of Peel Ports, in Liverpool will be asked to vote on industrial action after a 7% pay offer was considered to be not enough and workers were not given an agreed bonus.” https://t.co/m5NIZ4EEiU